The Scientific Research and Experimental Development (SR&ED) Program is a federal tax incentive program designed to encourage Canadian businesses of all sizes and in all sectors to conduct research and development (R&D) in Canada. The program is administered by the Canada Revenue Agency (CRA.

The SR&ED program allows companies in Ontario and across Canada to claim tax refunds and credits based on a percentage of SR&ED eligible salary, consulting, and materials expenditures. The eligibility of these expenses rests on whether they were incurred during experimental development. If your company has its own product line or services related to “production” (production can be anything – software development, printing, manufacturing, etc.) then it very likely involves some experimental development.

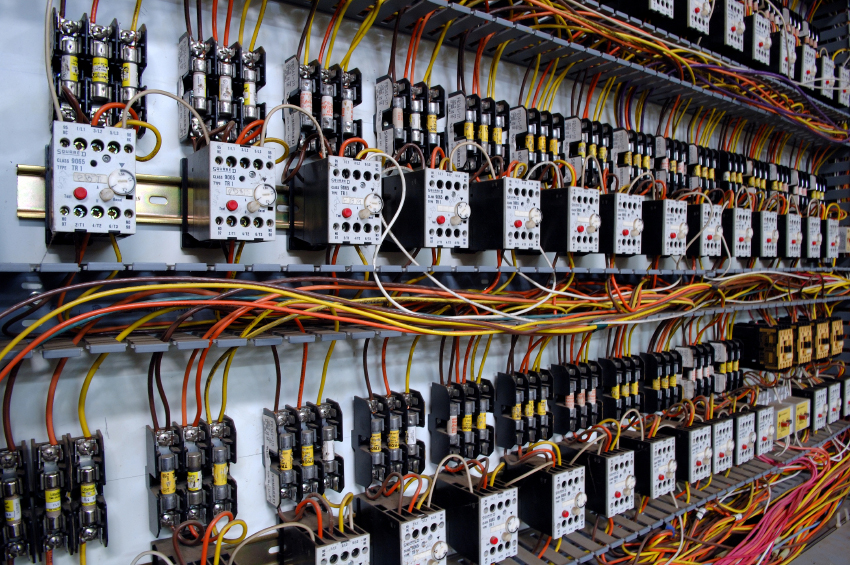

SRED Unlimited are SR&ED Consultants headquartered in Toronto, Ontario helping businesses across Canada successfully secure SR&ED tax credits and refunds using technical engineering consultants familiar with a host of industries (software development and digital media, telecommunications, mechanical or industrial engineering, electrical and electronics, injection moulding, tool and die, chemical, aerospace, cleantech and environmental technologies, renewable energy, biotech, food and beverage, printing and advanced manufacturing among others). We also help to prepare SR&ED claims to Medical Professional Corporations and other companies doing medical/healthcare research and development, and to the pharmaceutical companies. Our SR&ED consultants have an intimate understanding of technology and production processes. They conduct exploratory interviews with employees and technical leads at times that are convenient to your company. Then we write up SR&ED reports that best capture the SR&ED eligible nature of your experimental development and the claimable aspect of your expenses, and your company can approve the draft or suggest revisions.

SRED Unlimited has assisted many Ontario companies with claiming SR&ED tax credits and refunds, and these companies are located in many different cities such as Toronto, Kingston, Ottawa, London, Hamilton, St. Catharines – Niagara, Barrie, Guelph, and Oshawa, and regions such as Niagara, Kitchener-Waterloo, Windsor Essex , Kawartha Lakes ,Muskoka, and Northern Ontario. From Ontario craft brewers to advanced data mining centers, all kinds of Ontario companies have engaged in SRED eligible experimentation and SRED claimable expenditures—and sometimes they don’t believe what they can claim until SRED Unlimited enters the picture and shows what’s possible.